Shawnee County District Court is providing the following forms and self-help resources. A tax warrant acts as a lien against real property you own in the county in which it is filed and against your personal property.

Also called a lien the warrant is a public record that allows the government to claim your personal property or assets to satisfy the unpaid taxes.

State tax warrant. If you wait too long you might forfeit certain. You have up to 12 months from the date of issuance of the tax warrant to pay so long as monthly payments are being made. Court Technology and the state Department of Revenue DOR have collaborated to create a Tax Warrant interface that will allow Clerks of the Circuit Court to seamlessly process Tax Warrants electronically reducing manual data entry making public records easily searchable and providing accurate records in a more timely manner.

Each state also has its own rules on how they can be released. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. A tax lien also called a tax warrant sets the stage for a foreclosure lawsuit.

This not only creates a public record of the tax debt but also creates a lien on your real and personal property such as cars homes and cash in your bank accounts. The court cannot provide you with legal advice and you will be held to the same standard as a licensed attorney. A tax warrant creates a lien against real and personal property and gives the state law enforcement officers or tax officers the ability to enforce all other collection actions.

We request a 20 down payment of the total amount owed. If you received a tax warrant from our Office and need to pay the balance please use one of the. Due to laws protecting the state and federal government tax creditors possess special rights.

This is double the ten years given for the IRS Collection Statute Expiration Date. The warrant is filed with the Clerk of Court and is a public record of the amount you owe. Welcome to the OTC Online Tax Warrant System.

Some Issuers may have specific rules or requirements. When a tax warrant is filed with the Superior Court in the county where the taxpayer owns real or personal property a lien is created. The lien encumbers all real and personal property used in the business and owned by the taxpayer.

This Tax Warrant Collection System will not accept liability for Claims more than one year after the Transaction to which the Claim relates. This Tax Warrant Collection System reviews Claims during Our business hours which are from 800 AM to 500 PM Central Time Zone Monday through Friday Holidays excluded. This is a restricted site for use only by authorized Oklahoma governmental entities If you require access please complete and send an access request form to the Oklahoma Tax Commission.

As the New York State Department of Taxation and Finance explains it A tax warrant is a legal action against you and creates a lien against your real and personal property It is the equivalent of the IRS Federal Tax Lien. So if you want to avoid foreclosure take care of tax liens as quickly as possible. The State of New York has 20 years from the date a warrant could have been filed to collect on a tax debt.

State Tax Warrants Caution. Most state tax liens work similarly to an IRS lien. We file a tax warrant with the appropriate New York State county clerks office and the New York State Department of State and it becomes a public record.

So What is the NYS Tax Warrant Statute of Limitations. What Takes Place After The State Of New York Issues A Tax Warrant. States also use various names for liens one common term is a tax warrant which is the equivalent of a tax lien.

If a tax warrant issued against you it common for a NYS agent to appear at your home to discuss your past due tax problem. Please note that these resources are presented for informational purposes only and do not constitute legal advice. Please call 317-327-2448 for assistance.

However they all have their own set of rules when it comes to liability amounts they will file them. If you have a State of Kansas Tax Warrant. A tax warrant is equivalent to a civil judgment against you and protects New York States interests and priority in the collection of outstanding tax debt.

A filed tax warrant creates a lien against. If you fail to pay your state taxes or resolve the past due balance within a reasonable time the tax bureau in your state likely will issue a tax warrant in your name. All delinquent debt is subject to having a tax warrant filed.

The tax warrant typically is filed in every county where you have property. A tax warrant authorizes an officer of the New York State Department of Taxation and Finance to pursue aggressive collection activity against you. All previously scheduled appearance dates for tax warrant issues have been postponed.

A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to. Tax Warrants Pay Your Balance Online or by Mail Until further notice on-site tax payments will not be accepted to limit the spread of COVID-19. If you have unpaid taxes and have received notification of a tax warrant heres what you.

Tax warrants precede all forcible collection actions including levies income executions and property seizure. A tax warrant is a document that the department uses to establish the debt of a taxpayer. What is a State Tax Lien or State Warrant.

For this reason tax creditors pose a unique threat to your property. Once your payment information is received the State will be notified of.

Ronalda Ay Nicholas Ronalda Ay Nicholas Invalid Tax Warrant

Ronalda Ay Nicholas Ronalda Ay Nicholas Invalid Tax Warrant

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org

New York State Tax Collections When Nys Wants Back Due Tax Debt

New York State Tax Collections When Nys Wants Back Due Tax Debt

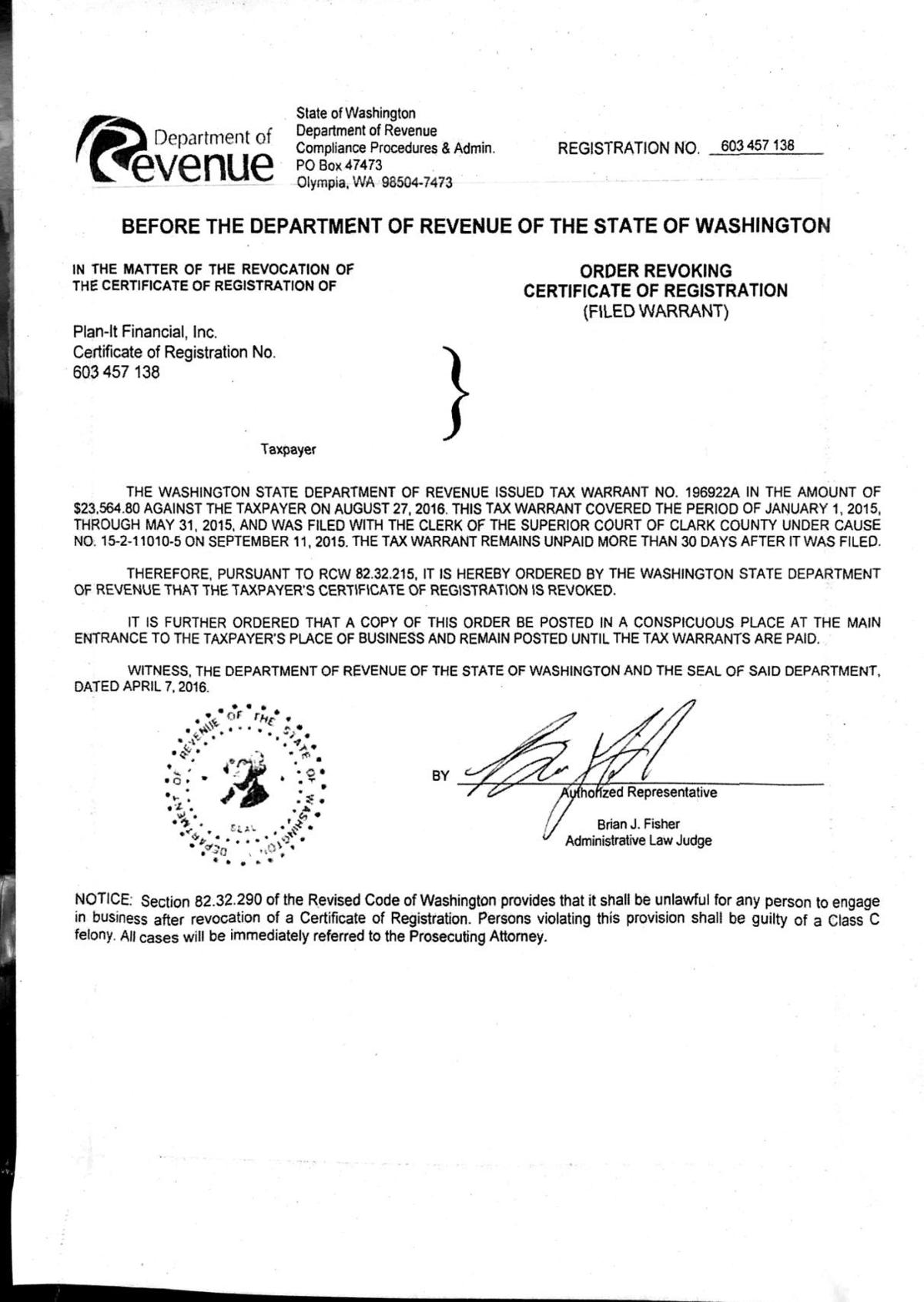

Frack Burger Closes Because Owner Owes 23k In State Back Taxes Local Tdn Com

Frack Burger Closes Because Owner Owes 23k In State Back Taxes Local Tdn Com

Picture Of California Tax Refund Iou Registered Warrant My Money Blog

Picture Of California Tax Refund Iou Registered Warrant My Money Blog

Verify A Refund Check Department Of Taxation

Verify A Refund Check Department Of Taxation

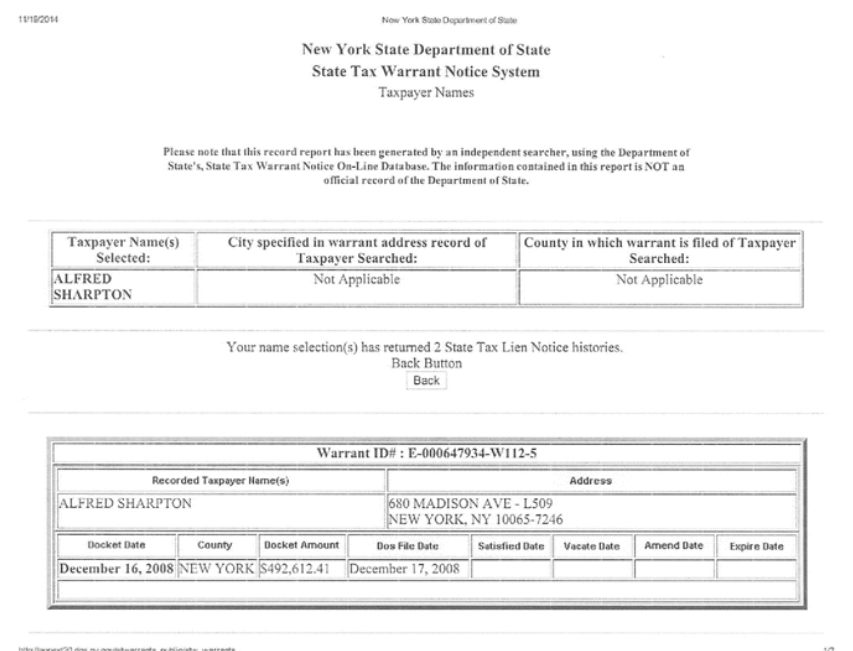

New York State Tax Warrants Against Sharpton And Revals The New York Times

New York State Tax Warrants Against Sharpton And Revals The New York Times

A01 Tax Evasion Warrant Ehri Online Course In Holocaust Studies

A01 Tax Evasion Warrant Ehri Online Course In Holocaust Studies

New York State Tax Warrant Know Your Rights Settle

New York State Tax Warrant Know Your Rights Settle

Al Sharpton Criticizes New York Times Report On Unpaid Taxes The New York Times

Al Sharpton Criticizes New York Times Report On Unpaid Taxes The New York Times

Https Www Leaderherald Com News Local News 2018 03 City Business Seized By State

How To Redeem California Tax Income Return Warrants Personal Finance Money Stack Exchange

How To Redeem California Tax Income Return Warrants Personal Finance Money Stack Exchange

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.