There are currently 23212 properties with a median home value in Maryland of 291000. The Maryland Department of Planning MDP Planning Data and Research Unit is responsible for maintaining tax maps for the 23 counties in Maryland.

1 Kiara Close Maryland Nsw 2287 Realestate Com Au

1 Kiara Close Maryland Nsw 2287 Realestate Com Au

5451 Wingborne Ct Columbia MD 21045.

Maryland real property value. To ensure the accuracy of assessments the Division makes an annual assessment ratio survey by comparing actual sales with assessment levels in various subdivisions. This screen allows you to search the Real Property database and display property records. Method of construction s 11-125.

Values and sold prices last 24 months United States Maryland. 2 over the last 10 years. Property maps provided courtesy of the Maryland Department of Planning.

While we have confidence in the accuracy of these records the Department makes no. Number of sales over 250k. Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year.

An appraisal is an estimate of value. Since the Comptrollers Office does not process property. SDAT Real Property Division conducts property assessments.

Assessments are certified by the Department to local governments where they are converted into property tax bills by applying the appropriate property tax rates. In Maryland assessments are conducted once every three years and property owners will be informed of any changes to their assessment by late December. The 4th Quarter index value was 186 points lower than the 3rd Quarter 2018 index value of 48324 resulting in a 038 decline for the 4th Quarter in the Maryland Market.

An assessment is based on an appraisal of the fair market value of the property. Provides assessment roll information. The median home value in Maryland is well above the national average at 289900 and expected to continue to rise.

When property values increase the increase is phased-in equal increments over the next three years. Counties in Maryland collect an average of 087 of a propertys assesed fair market value as property tax per year. Enter an address or account number and the system will estimate real property tax plus other non-tax charges a new owner will pay in the first full fiscal year of ownership.

Over the last thirty years it is up 162. Tax amount varies by county. The following pages are for information purpose only.

And maintains our records based on the official records recorded among Land Records. Customers should file an appeal when the estimated value of their property does not accurately reflect what they believe to be its current market value. Preston Street Baltimore MD 21201.

How condominium terminated s 11-124. If a plat for a property is needed contact the local Land Records office where the property is located. Find your local jurisdictions rate and add 0112 for every 100.

To calculate your property taxes first find your property tax assessment. Average total tax amount. This survey also determines how well local assessment offices are keeping pace.

The median list price per square foot in Maryland is 173. The assessment appeal process allows property owners the opportunity to dispute the value determined by the Department. Average pricesqft----Average sold price.

The data is not to be used for legal reports or documents. A property with a base value of 100000 and a current value of 130000 would have the 30000 increase phased-in over the next three years. The Maryland real estate market is hot for 2019.

The Department of Assessments and Taxation must appraise each of these properties once every three years. Number of sales over 10m. Of the total homes in Maryland 89 are for sale 11 are for rent and 59 are single family homes.

The Maryland Department of Assessments and Taxation administers and enforces the property assessment and property tax laws of Maryland. The tax levies are based on property assessments determined by the Maryland Department of Assessments and TaxationSDAT. The median property tax in Maryland is 277400 per year for a home worth the median value of 31860000.

Divide that by 100. Tax Maps are meant to provide a graphic representation of real property by reflecting individual property boundaries in relationship to contiguous real property. - Townhouse for sale.

While we strive to provide the most accurate assessments possible Customers sometimes feel that the Departments estimate of their property value is incorrect. Estimated Real Property Tax and Other Non-tax Charges. Click here for a glossary of terms.

LONG FOSTER REAL ESTATE INC. Home prices in the Maryland Real Estate Market have gained 267 over the last 12 months. Enter one of the following to calculate estimated property tax and other non-tax charges.

Deleted accounts can only be selected by Property Account Identifier. Property values rise and fall to reflect the market. Number of sales over 1m.

Users noting errors are urged to notify the Maryland Department of Planning Mapping 301 W. Maryland home values rose 25 over the last 12 months and are expected to rise another 08. Marylands system of real property assessment has been based on 100 percent of the market value of the property since July 2001 Chapter 80 Acts of 2000.

The assessment will be for both the property and whatever real estate is located on the property. If a propertys value decreases the phase-in value is the same as the current value. There are 24 local State assessment offices one in each county and Baltimore City.

Understanding Your Property Assessment Notice City Of Takoma Park

Understanding Your Property Assessment Notice City Of Takoma Park

The Ultimate Guide To Maryland Real Estate Taxes Clever Real Estate

The Ultimate Guide To Maryland Real Estate Taxes Clever Real Estate

Top 5 Best Real Estate Investment Markets In Maryland Clever Real Estate

Top 5 Best Real Estate Investment Markets In Maryland Clever Real Estate

101 Things You Need To Know About The Maryland Real Estate Market

101 Things You Need To Know About The Maryland Real Estate Market

Baltimore Real Estate Market 2020 Housing Forecast Trends

Baltimore Real Estate Market 2020 Housing Forecast Trends

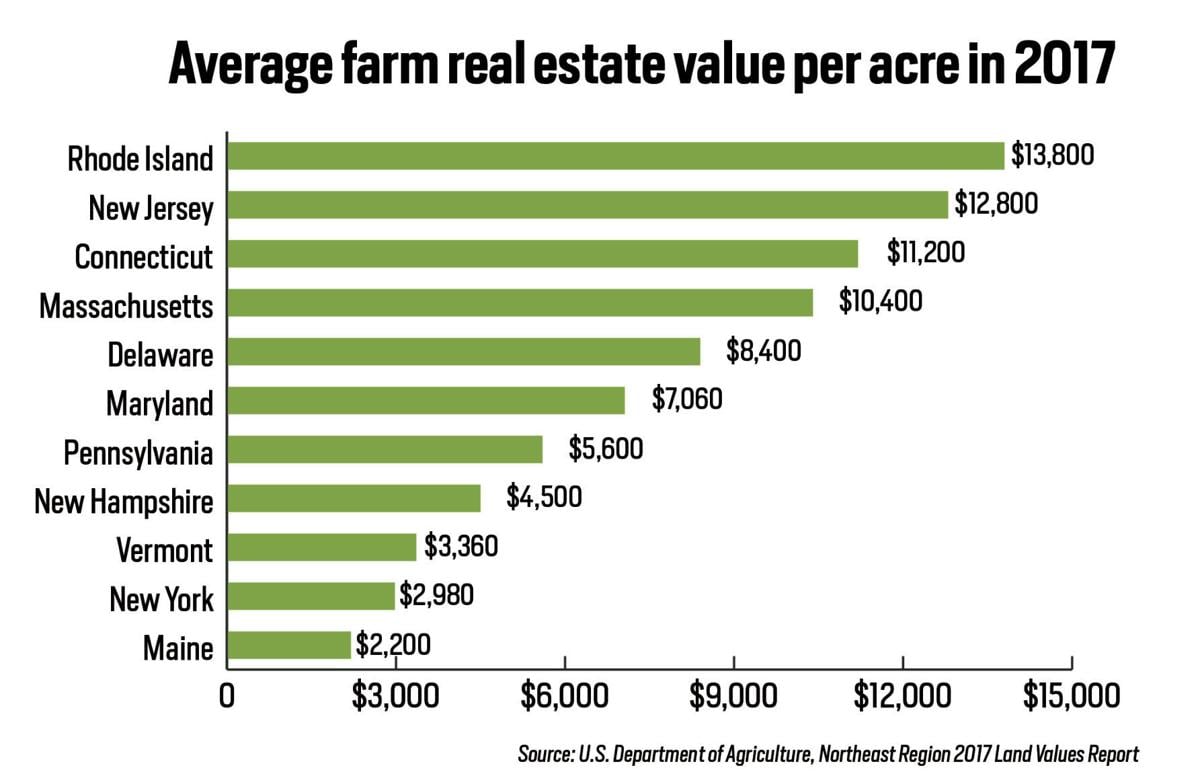

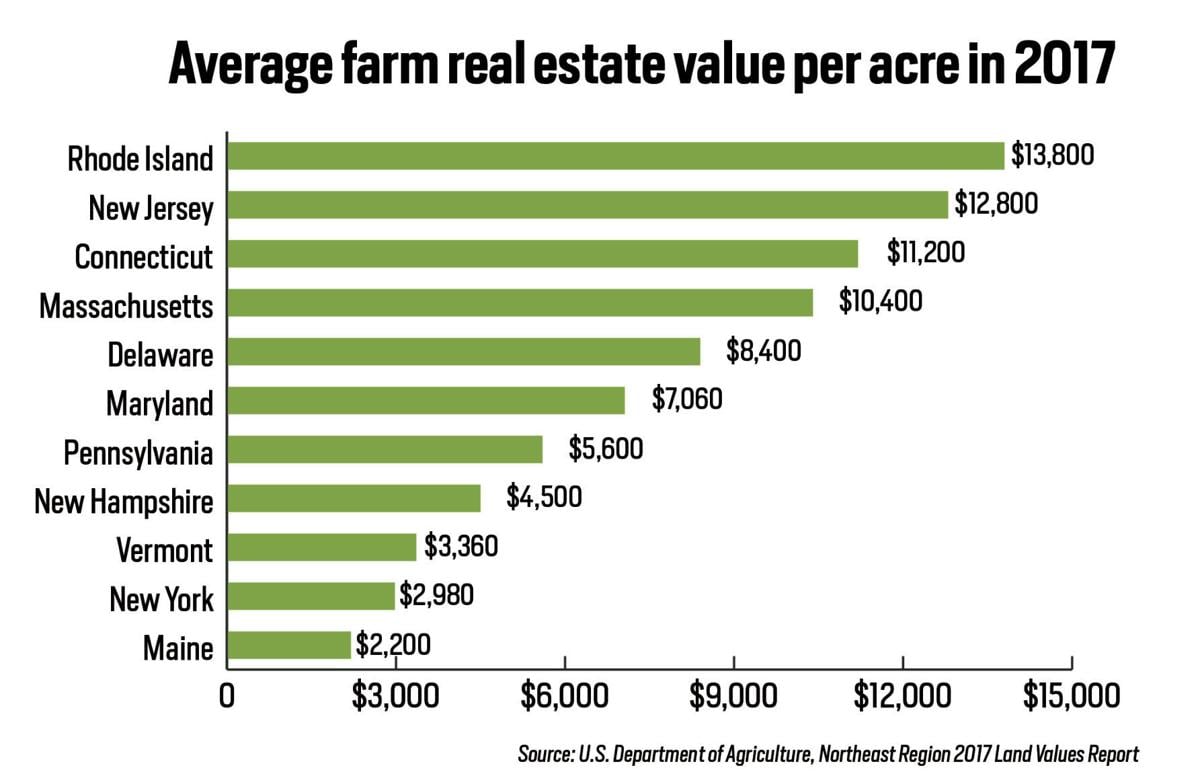

Value Of Frederick Farmland Far Exceeds National Average According To Usda Report Agriculture Fredericknewspost Com

Value Of Frederick Farmland Far Exceeds National Average According To Usda Report Agriculture Fredericknewspost Com

Understanding Your Property Assessment Notice City Of Takoma Park

Understanding Your Property Assessment Notice City Of Takoma Park

Baltimore Real Estate Market 2020 Housing Forecast Trends

Baltimore Real Estate Market 2020 Housing Forecast Trends

Maryland Home Prices Md Home Values And Property Values Homegain

Office Of The State Tax Sale Ombudsman

Office Of The State Tax Sale Ombudsman

Maryland Home Prices Md Home Values And Property Values Homegain

Maryland 2021 Real Estate Market Appreciation Housing Market Trends Neighborhoodscout

Maryland 2021 Real Estate Market Appreciation Housing Market Trends Neighborhoodscout

How Does Access To Frequent Transit Correlate With Property Values In Baltimore Greater Greater Washington

How Does Access To Frequent Transit Correlate With Property Values In Baltimore Greater Greater Washington

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.