If you dont have insurance youll pay a hefty fine unless you qualify for an exemption more on exemptions here. 12000 for a single filer in 2018 was used to calculate the penalty.

Is It True That I Will Have To Buy Health Insurance Or Pay A Fine

Is It True That I Will Have To Buy Health Insurance Or Pay A Fine

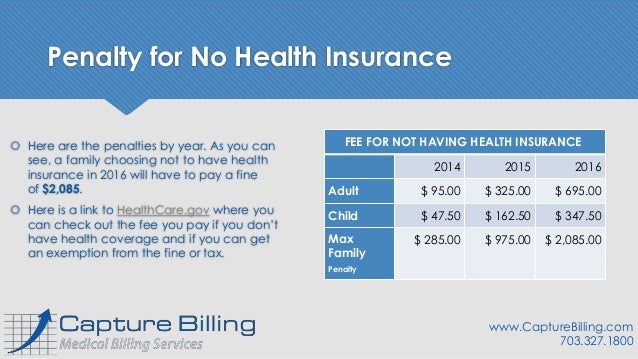

For 2018 the penalty is 695 for each adult and 34750 for each child without insurance.

What's the fine if you don t have health insurance. In 2018 according to a report by the US. If youre uncovered only 1 or 2 months you dont have to pay the fee at all. When the Affordable Care Acts ACA otherwise known as Obamacare individual mandate took effect in 2014 so did the penalty for going without health insurance.

You will NOT get Form 1095-A unless you or someone in your household had Marketplace coverage for all or part of 2020. Vermont has instituted a health insurance penalty for. If you did not have coverage prior to 2019 and didnt qualify for an exemption you had to pay the greater of these two amounts.

Learn how your comment data is processed. This site uses Akismet to reduce spam. The individual mandate means most people are required to purchase health insurance.

California is not alone in reinstating the individual mandate. Check with your state or tax preparer. A taxpayer who fails to get health insurance that meets the states minimum requirements will be subject to a penalty of 695 per adult and 34750 per child under 18 or 25 of annual household income whichever is higher when they file their 2020 state income tax return in 2021.

If you dont have health insurance you must either get an exemption or pay a penalty. 25 of your yearly household income. And this means that in those places you still must have health insurance or pay a health insurance penalty on your income tax return for the tax year you did not have minimum essential coverage.

Theres a bit of. Grab our step-by-step guide to enrolling in Marketplace coverage aka Obamacare or Affordable Care Act insurance to learn more. Vermont has instituted a health insurance penalty for uninsured individuals in that state.

Health insurance tax penalties were introduced at the federal level with the Affordable Care Act or Obamacare. For 2014 the fine is the greater of 95 per person or 1 of household income above the. However with the elimination of the federal health insurance penalty they will begin charging a state fee.

The health insurance penalty law goes into effect in 2020. Having health insurance is important. Its not surprising that many people are confused about the status of the law and the penalty.

Consumer Reports health insurance experts explain. In the past they did not assess a health insurance penalty if someone paid one at the federal level. However with the elimination of the federal health insurance penalty they will begin charging a state fee.

The amount is capped at 2085 per family or 25 percent of your family income whichever is higher. If you live in a state that requires you to have health coverage and you dont have coverage or an exemption youll be charged a fee when you file your 2020 state taxes. Millions of Americans have gained health coverage under the Affordable Care Act ACA.

The federal law was repealed and coverage was not mandatory in the state of California in 2019. If you have coverage for part of the year the fee is 112 of the annual amount for each month you or your tax dependents dont have coverage. If you get covered during open enrollment or have less than 3 months without coverage then you wont owe the fee for those months.

The only months you are penalized for are FULL months you dont have health insurance or an exemption for. The penalty for a family of four with 2 children is a minimum of 2085. Census 85 percent of people or 275 million adults between the ages of 19-64 did not have health insurance at.

Using the per person method you pay only for people in your household who dont have insurance coverage. This meant that all taxpayers across the country were required to obtain health insurance coverage or pay a tax penalty. Until recently if you didnt enroll in minimum essential coverage and were not exempt from the mandate you could owe a federal tax penalty known as the shared responsibility payment.

Without health insurance one visit to the emergency room could easily cost you over 1000 or in some cases 10000 or more. Only the amount of income above the tax filing threshold ex. Those who dont maintain qualifying health coverage may face a penalty unless they qualify for a hardship exemption.

Figuring out your potential exposure if youre uninsured isnt simple.

What Are The Fines For Not Being Insured If You Choose Not To Buy Health Insurance In 2015 Even If You Can Afford Buy Health Insurance Health Insurance Health

What Are The Fines For Not Being Insured If You Choose Not To Buy Health Insurance In 2015 Even If You Can Afford Buy Health Insurance Health Insurance Health

What Happens If You Don T Have Any Health Insurance Insurance Neighbor

What Happens If You Don T Have Any Health Insurance Insurance Neighbor

If You Or Your Dependents Don 39 T Have Minimum Coverage You May Pay One Of Tw Health Insurance Humor Supplemental Health Insurance Health Insurance Coverage

If You Or Your Dependents Don 39 T Have Minimum Coverage You May Pay One Of Tw Health Insurance Humor Supplemental Health Insurance Health Insurance Coverage

How Big Is The Penalty If You Don T Get Health Insurance

How Big Is The Penalty If You Don T Get Health Insurance

Student Insurance Studenten Zorgverzekeringen Nl

Student Insurance Studenten Zorgverzekeringen Nl

Do You Qualify For A Health Insurance Penalty Exemption Taxact

Do You Qualify For A Health Insurance Penalty Exemption Taxact

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

What Is The Penalty For Not Having Health Insurance In 2021 Independent Health Agents

What Is The Penalty For Not Having Health Insurance In 2021 Independent Health Agents

Is It Ok To Be Uninsured 5 Things You Need To Know Ehealth Insurance

Is It Ok To Be Uninsured 5 Things You Need To Know Ehealth Insurance

What If I Don T Have Health Insurance H R Block

What If I Don T Have Health Insurance H R Block

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

What Is The Fee For Not Having Health Insurance Coverage

What Is The Fee For Not Having Health Insurance Coverage

Is It Ok To Be Uninsured 5 Things You Need To Know Ehealth Insurance

Is It Ok To Be Uninsured 5 Things You Need To Know Ehealth Insurance

What Happens If You Don T Have Health Insurance

What Happens If You Don T Have Health Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.