Type July 1 2019 to March 31 2020 April 1 2020 to March 31 2021 April 1 2021 to March 31 2022 Beginning April 1 2022. Table 2 Rates of fuel charge for Nunavut and Yukon.

Https Energyinnovation Org Wp Content Uploads 2020 04 Effects Of A 0 25 Federal Gas Tax April 2020 Update Pdf

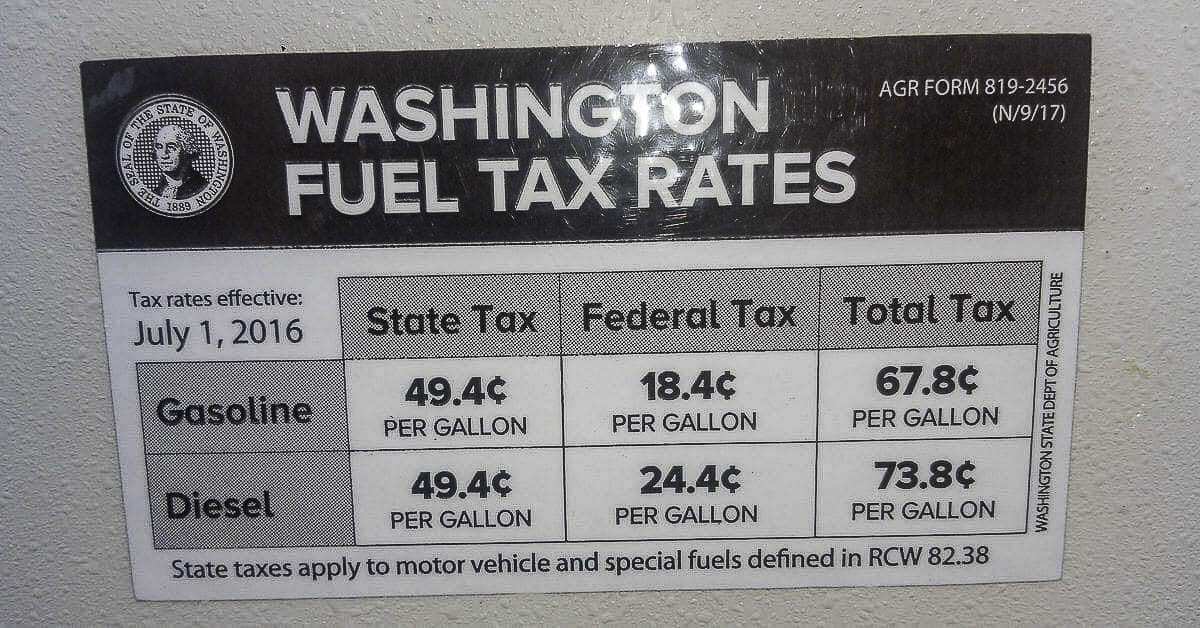

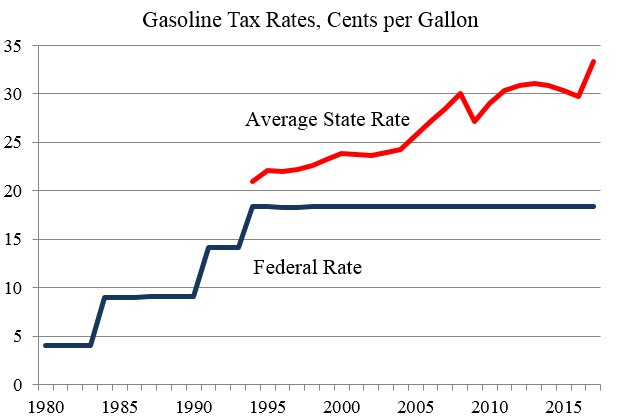

The federal gasoline tax is 184 cents per gallon for unleaded and 244 cents for diesel.

Federal gas tax increase 2021. Gas tax is different for gasoline diesel aviation fuel and jet fuel. Gasoline prices are much higher in 2021. Critics are calling a potential increase in the federal gas tax the wrong policy at the wrong time Monday January 25 2021.

Updated May 01 2021. The idea of raising a broad-based and regressive tax right now is just a political non-starter said Marc. Regressive tax structures are those that when applied uniformly take a larger percentage of income from low earners than high earners.

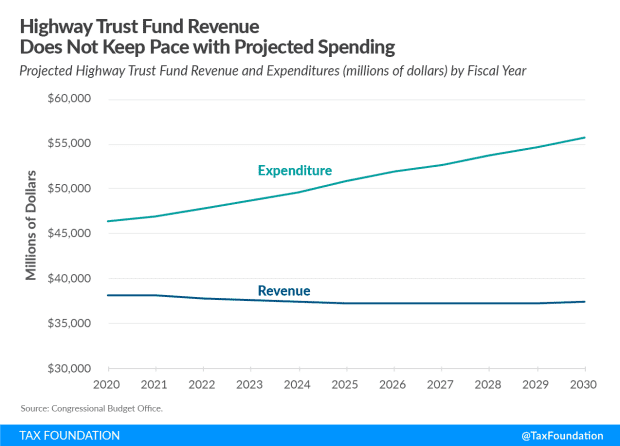

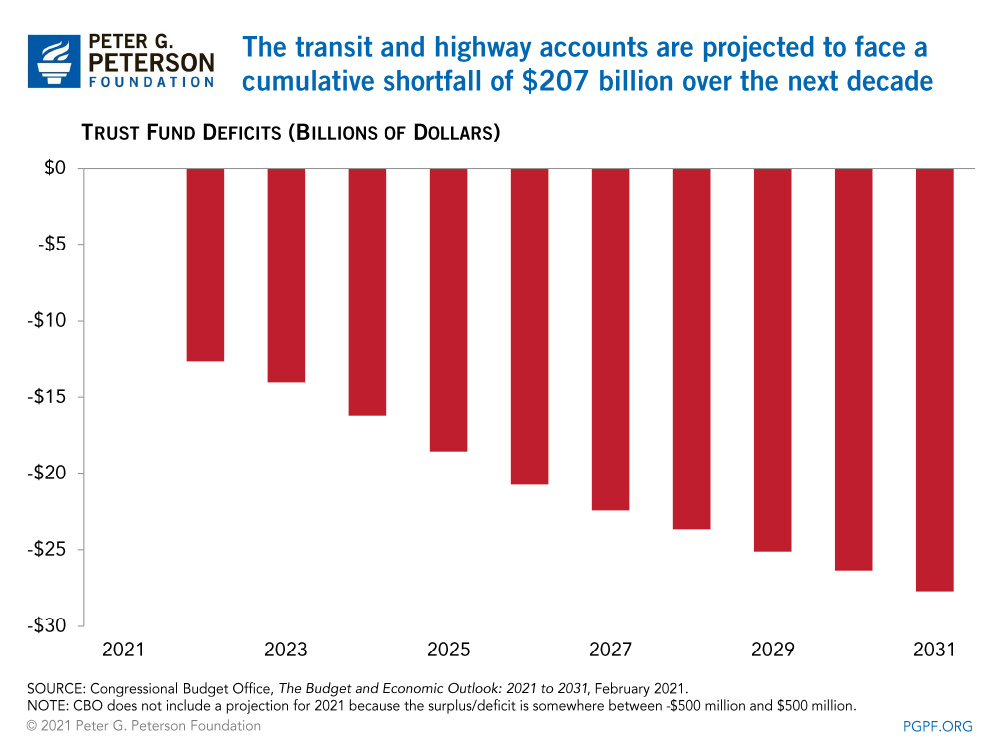

The increases include an 18-cent gas tax increase over the next two years raising the total in state and federal taxes to 854 cents a gallon making it the highest gas tax in the nation. In the United States the federal motor fuel tax rates are. That total tax revenue flows to the Highway Trust Fund which was expected to.

Chamber of Commerce proposed phasing in a 25-cent-a-gallon increase in the gas tax over five years to generate nearly 400 billion over a decade. Others are promoting green initiatives that could see increases at the pump. Diesel fuel taxes would be raised to 21 cents under the proposed plan.

And an increase to the federal gas tax should be out of the question. The current 2021 US. What they may not know is theyre paying approximately 13248 in federal gas taxes.

In 2021 the 28 percent AMT rate applies to excess AMTI of 199900 for all taxpayers 99950 for married couples filing separate returns. The tax pays for transportation-related infrastructure projects as well as mass transportation costs across the US. A progressive tax in contrast is one that takes a larger.

And according to Pete Buttigieg that number may soon be increasing. AMT exemptions phase out at 25 cents per dollar earned once taxpayer AMTI hits a certain threshold. January 21 2021 852 PM ET.

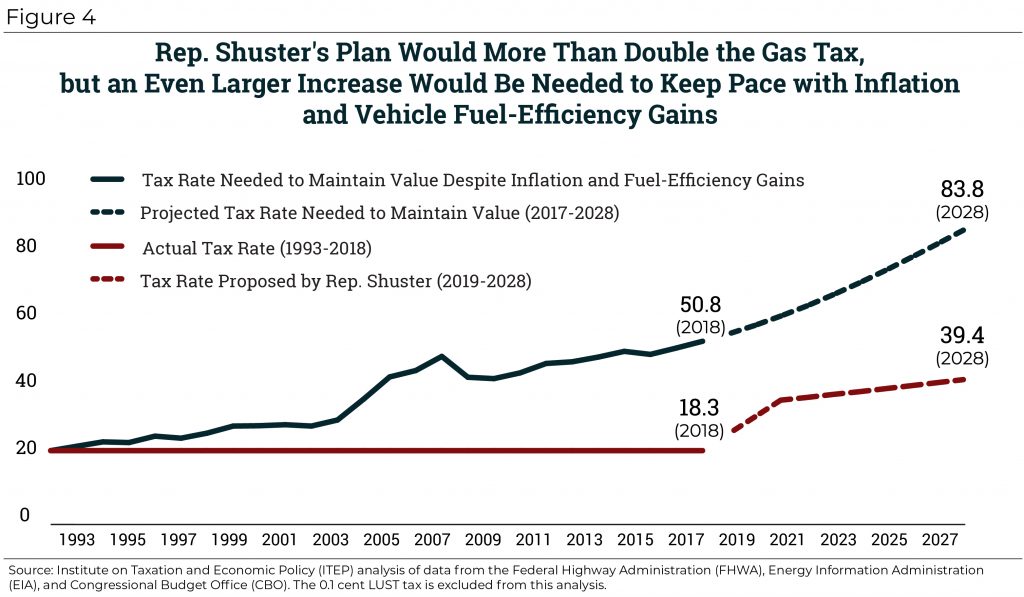

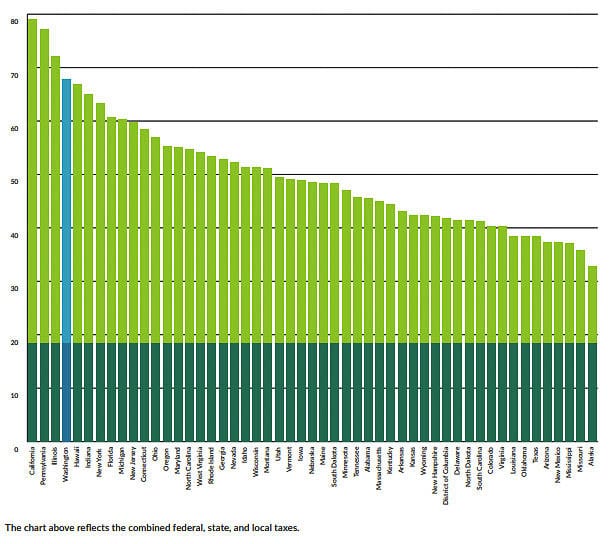

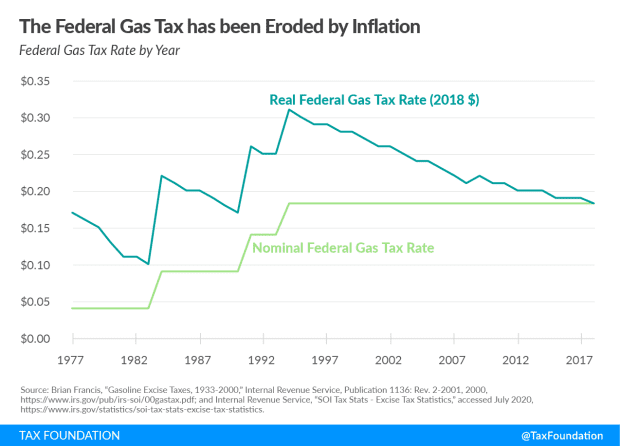

And getting frozen in time for 28 years has consequences. Simply adjust the rate for inflation and the federal gas tax would be 33 cents per gallon today. CoPilot used 2021 data from the American Petroleum Institute to rank states with the highest gasoline and diesel taxes.

The federal gasoline excise tax was first introduced in 1933 at just 1 cent per gallon. The rate has been raised 10. Average tax rate stands at 3683 per gallon for gasoline and 3785 for diesel fuel.

A gas tax or fuel tax is an excise tax imposed on the sale of fuel. Biden has vowed not to increase taxes on anyone making less than 400000 a year. Transportation Secretary nominee Pete Buttigieg suggested raising the federal gas tax in order to fund infrastructure initiatives during his confirmation hearing Thursday before the Senate Commerce Science and Transportation Committee.

Gas taxes both those imposed federally or at the state level are regressive. Sin taxes increase will come soon and 100 increase in gas in the last 45 days and you can bet gas will go above 400 very soon And with little Alfred E Newman bootinthebutt in charge of the Communist Chao Transportation position hold on tight. In 2018 the US.

During a recent confirmation hearing before the Senate Commerce Science and Transportation Committee Buttigiegwho is President Bidens nominee for Transportation Secretarystated he was open to raising the federal gas tax to. Increase in the cost of gasoline soft drinks and cigarettes as of January 1 2021 Each year the tax adjustment is made therefore the Ministry of Finance updated the IEPS quotas applicable to.

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Highest Gas Tax And Prices In The U S By State 2020 Statista

Highest Gas Tax And Prices In The U S By State 2020 Statista

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

Gas Tax Increases A Carbon Tax And A Low Carbon Fuels Tax Part Of Legislature S Transportation Tax Proposals Clarkcountytoday Com

Gas Tax Increases A Carbon Tax And A Low Carbon Fuels Tax Part Of Legislature S Transportation Tax Proposals Clarkcountytoday Com

Will A Transportation Funding Package Be In The 2021 Legislative Session Clarkcountytoday Com

Will A Transportation Funding Package Be In The 2021 Legislative Session Clarkcountytoday Com

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

The Federal Gasoline Tax Should Be Abolished Not Increased Mercatus Center

The Federal Gasoline Tax Should Be Abolished Not Increased Mercatus Center

Federal Gas Tax Increase Misguided Cato At Liberty Blog

Federal Gas Tax Increase Misguided Cato At Liberty Blog

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.