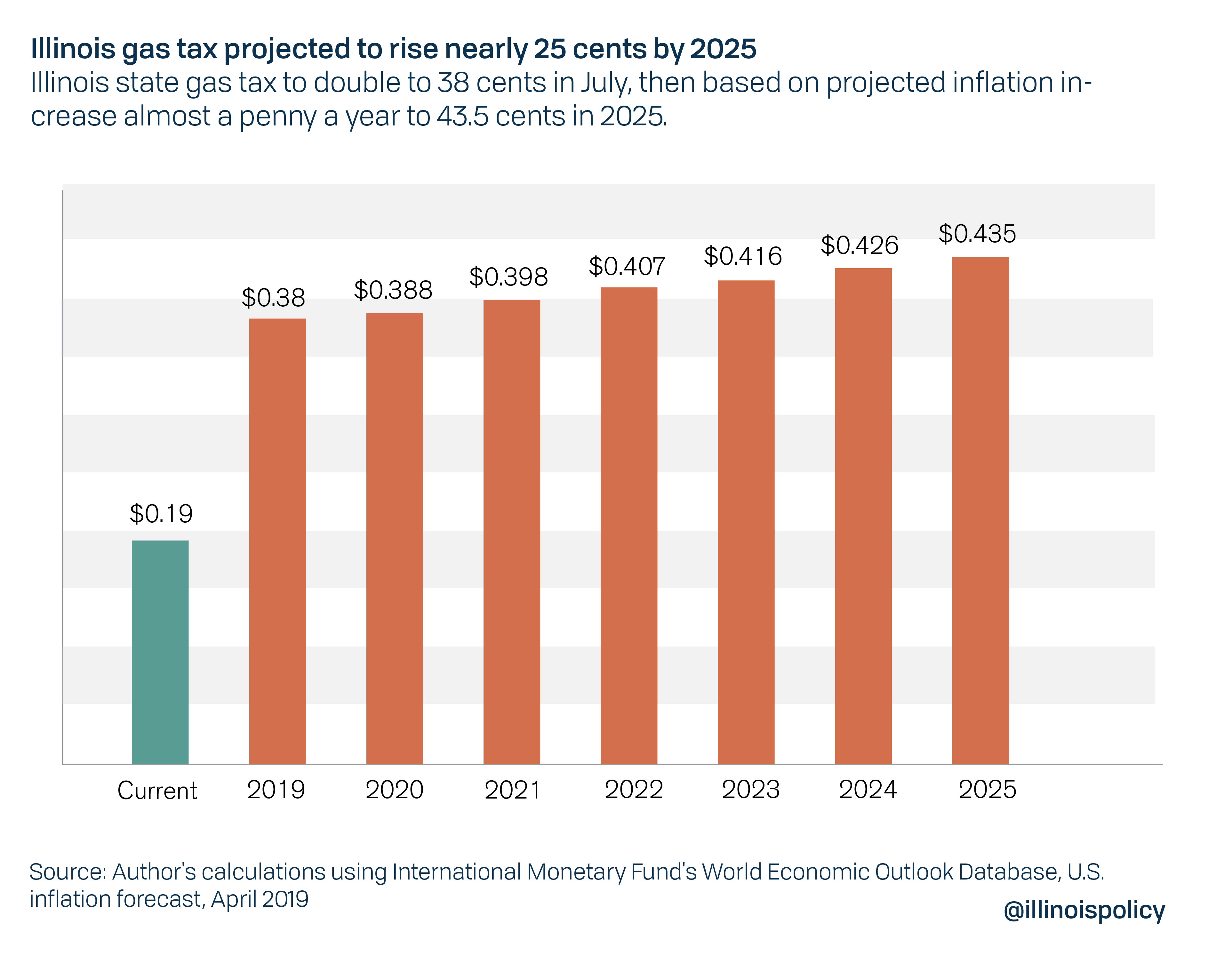

Schatz sponsored the legislation that increase the gas tax 25 cents over five years with a total hike of 125 cents by 2025. If the companies passed the tax onto consumers experts estimate it would increase the cost of a gallon of gas by 55 cents and raise the price of home heat by about.

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Instead the new gas taxes will be called carbon taxes which makes it easier to shame-silence objections to them.

New gas tax. Currently Missouri has the. Adding the 12 cents at 2-cent per year intervals will move that up to 2875 cents when complete. In effect this will be a regressive tax that would impact seniors and lower income New Yorkers the most.

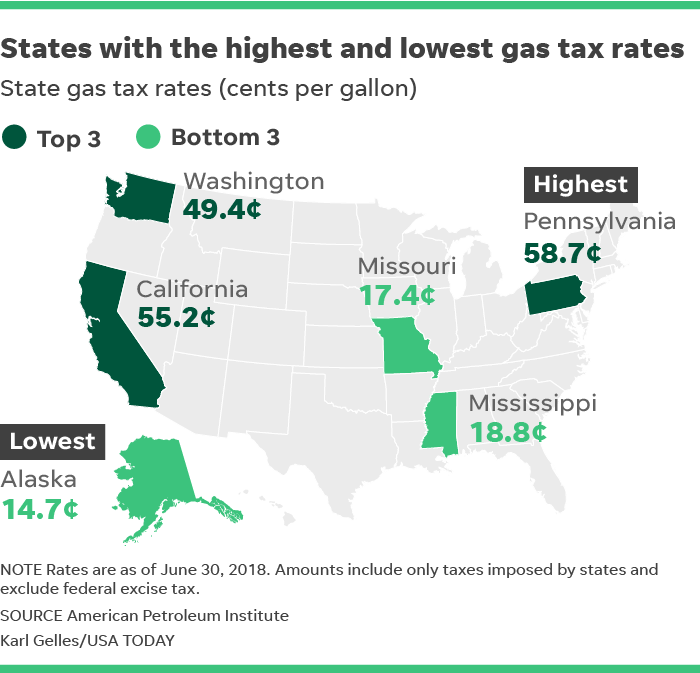

Only a handful of things like cigarettes are taxed more punitively and disproportionately. South Carolinas gas tax is currently 1675 cents per gallon. Which State has the Highest Tax Rate.

New York State Senate Republicans on Tuesday criticized a proposed bill which could increase the states gas tax raising prices by as much as 55 cents per gallon. On December 21 2020 Gov. Compare 2020 state fuel excise taxes by state 2020 gas tax rates by state and 2020 state gas tax rates with new map.

The highest tax rate on diesel is 0741 gallon again from Pennsylvania. What they may not know is theyre. 1 from 309 cents to 402 cents for gasoline and from 349 cents to 442 cents for.

AP A conservative advocacy groups Missouri chapter is seeking to put whats expected to be the states first gas tax hike in years to. There are five taxes that are imposed based on the taxable value of oil natural gas liquid hydrocarbons carbon dioxide helium and other non-hydrocarbon gases products severed in New Mexico. Congress set the taxes of 184 cents a gallon for gasoline and 243 cents a gallon for diesel fuel in 1993.

But for the average American who drives over 16000 miles per year the cost per gallon can quickly make a dent in their take home pay. Its a proposal which has also drawn the ire of local business leaders. Senator Helming said This proposal is a bad idea any day but its especially shocking given the current state of our economy.

In addition the oil and gas conservation tax applies to uranium coal and geothermal energy. To drive all those miles most individuals consume 720 gallons of gasoline a year. In 2018 the US.

In general the taxable value of products is the actual price of the product at the production unit less. Sin taxes increase will come soon and 100 increase in gas in the last 45 days and you can bet gas will go above 400 very soon And with little Alfred E Newman bootinthebutt in charge of the Communist Chao Transportation position hold on tight. Instead the new gas taxes will be called carbon taxes which makes it easier to shame-silence objections to them.

The first Forward Washington increased the states 498-cent gas tax up to 593 cents by July. Meanwhile the highest tax rate on aviation fuel is. This is an important tactical consideration for the Left especially because gas taxes are already the most regressive taxes on a necessity extant.

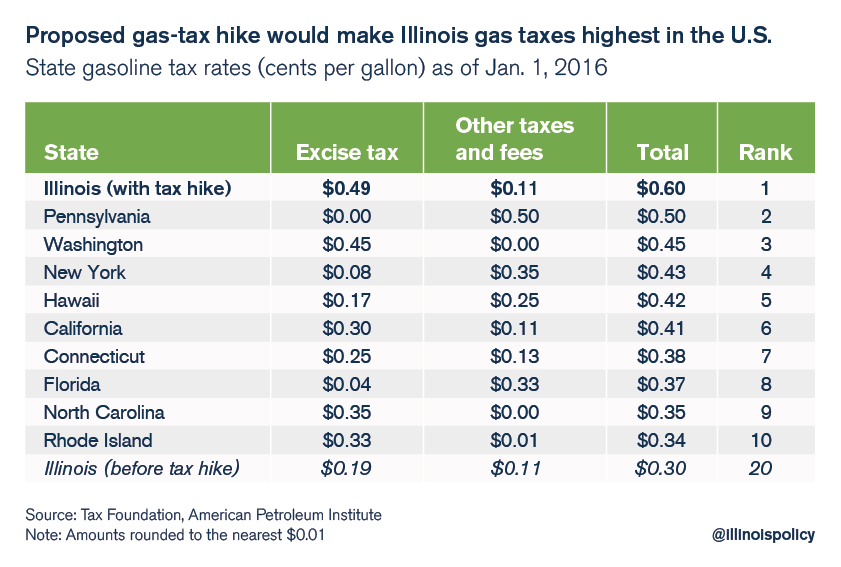

Chamber of Commerce proposed phasing in. This is an important tactical consideration for the Left especially because gas taxes are already the most regressive taxes on a necessity extant. The state with the highest tax rate on gasoline is Pennsylvania at 0586 gallon followed closely by California at 0533 gallon.

Currently Missouri has one of the lowest gas taxes in the country at. The proposal includes an additional 55 cents per gallon gas tax as well as increased taxes on heating oil and natural gas. Due to the formula explicitly outlined in the law the tax rate on gasoline and diesel fuel increased on Oct.

After a lengthy debate in the House Tuesday night members voted to increase the tax by 25 cents per gallon annually over five years starting later this year. California pumps out the highest tax rate of 6247 cents per gallon followed by Pennsylvania 587 cpg Illinois 5201 cpg and Washington 494 cpg. Ned Lamont signed Connecticut up for the Transportation and Climate Initiative TCI that will raise gasoline prices and cost Conne.

It succeeds two plans from Sen. Steve Hobbs D-Lake Stevens and Rep. When coupled with the current 105 cent motor fuels tax rate on gasoline and the 135 cent rate for diesel fuel the total tax rates for gasoline and diesel fuel are now 507 cents and 577 cents.

Only a handful of things like cigarettes are taxed more punitively and disproportionately.

Pritzker Signs Bill Doubling Illinois Gas Tax

Pritzker Signs Bill Doubling Illinois Gas Tax

California Gas Tax What You Actually Pay On Each Gallon Of Gas

California Gas Tax What You Actually Pay On Each Gallon Of Gas

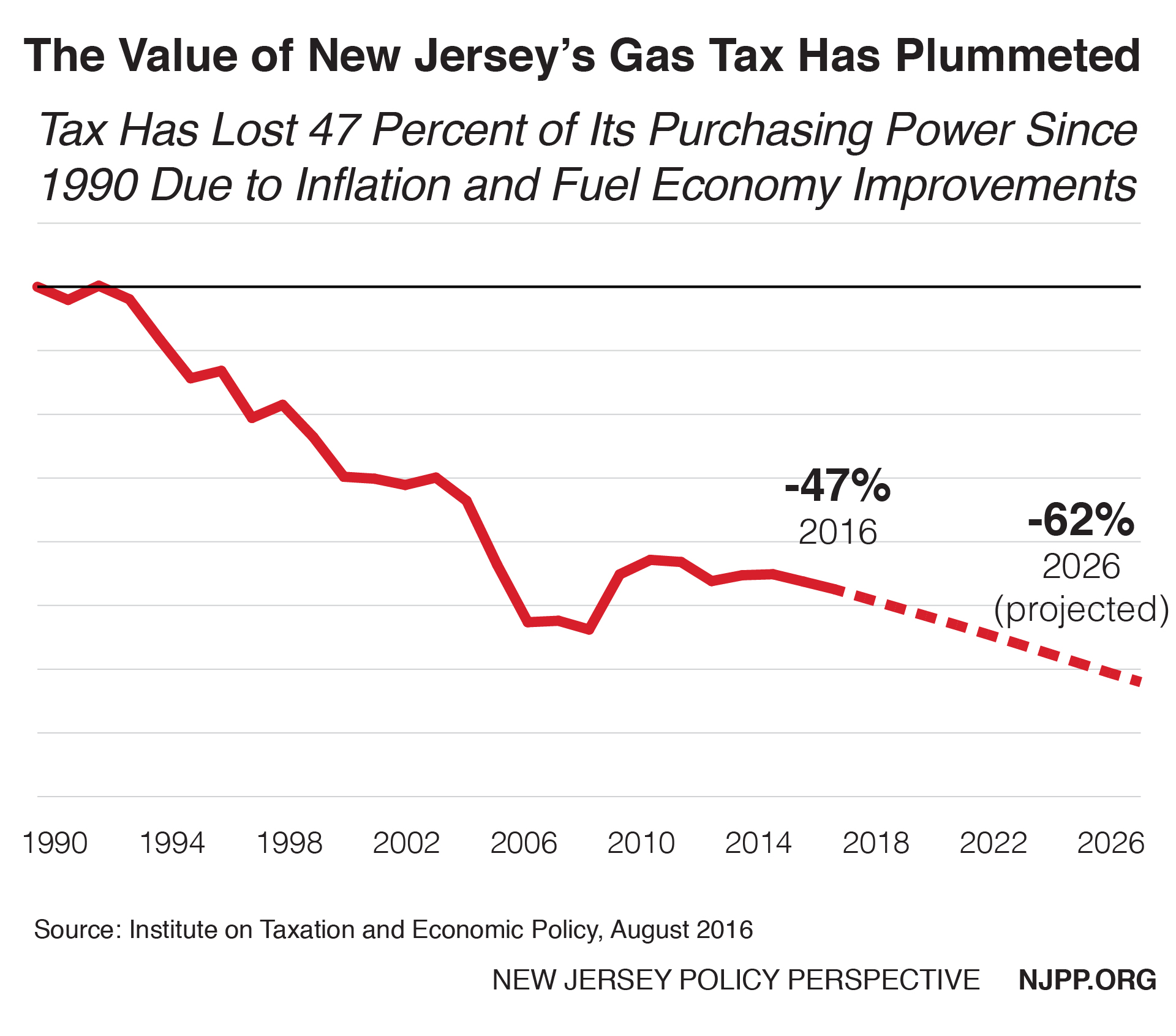

The Value Of New Jersey S Gas Tax Has Plummeted New Jersey Policy Perspective

The Value Of New Jersey S Gas Tax Has Plummeted New Jersey Policy Perspective

Column New Gas Tax Hike Adds To Sting Of Covid Hurt Chicago Tribune

Column New Gas Tax Hike Adds To Sting Of Covid Hurt Chicago Tribune

Highways And Gas Tax Diversions Cato At Liberty Blog

Highways And Gas Tax Diversions Cato At Liberty Blog

New Bill Would Make Illinois Gas Taxes Highest In The Nation

New Bill Would Make Illinois Gas Taxes Highest In The Nation

What Is The Gas Tax Rate Per Gallon In Your State Itep

What Is The Gas Tax Rate Per Gallon In Your State Itep

Rising Gas Taxes Which States Have Highest And Lowest Rates

Rising Gas Taxes Which States Have Highest And Lowest Rates

Garden State Lawmakers On Verge Of Passing Massive Gas Tax Hike Americans For Tax Reform

Garden State Lawmakers On Verge Of Passing Massive Gas Tax Hike Americans For Tax Reform

Tax On Gas What You Need To Know About Prop 6

Tax On Gas What You Need To Know About Prop 6

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

Gas Tax Hike Will Help New Jersey Pay For New Rail Tunnel Streetsblog New York City

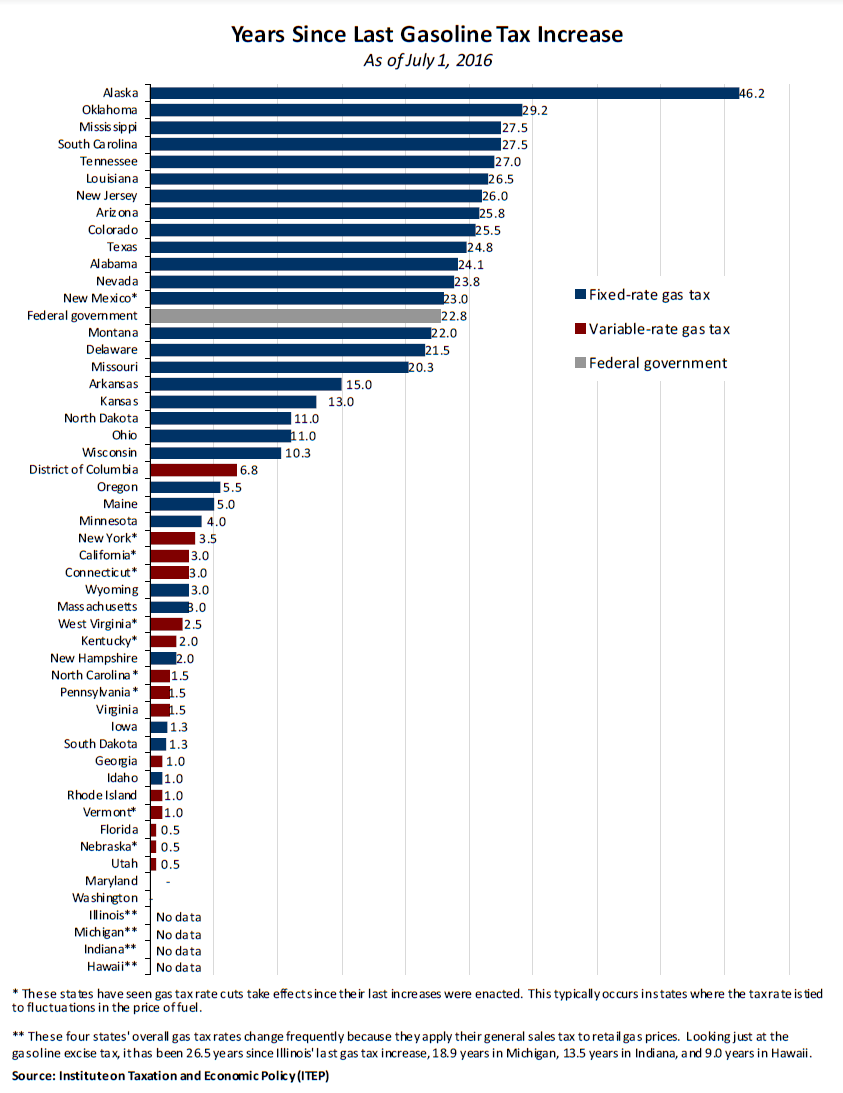

How Long Has It Been Since Your State Raised Its Gas Tax Itep

How Long Has It Been Since Your State Raised Its Gas Tax Itep

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.