Unemployment compensation including Railroad Unemployment Insurance Act RUIA payments Social security benefits Social security equivalent Tier 1 railroad retirement. If you are already receiving benefits or if you want to change or stop your withholding youll need a Form W-4V from the Internal Revenue Service.

Https Www Irs Gov Pub Irs Prior Fw4v 2012 Pdf

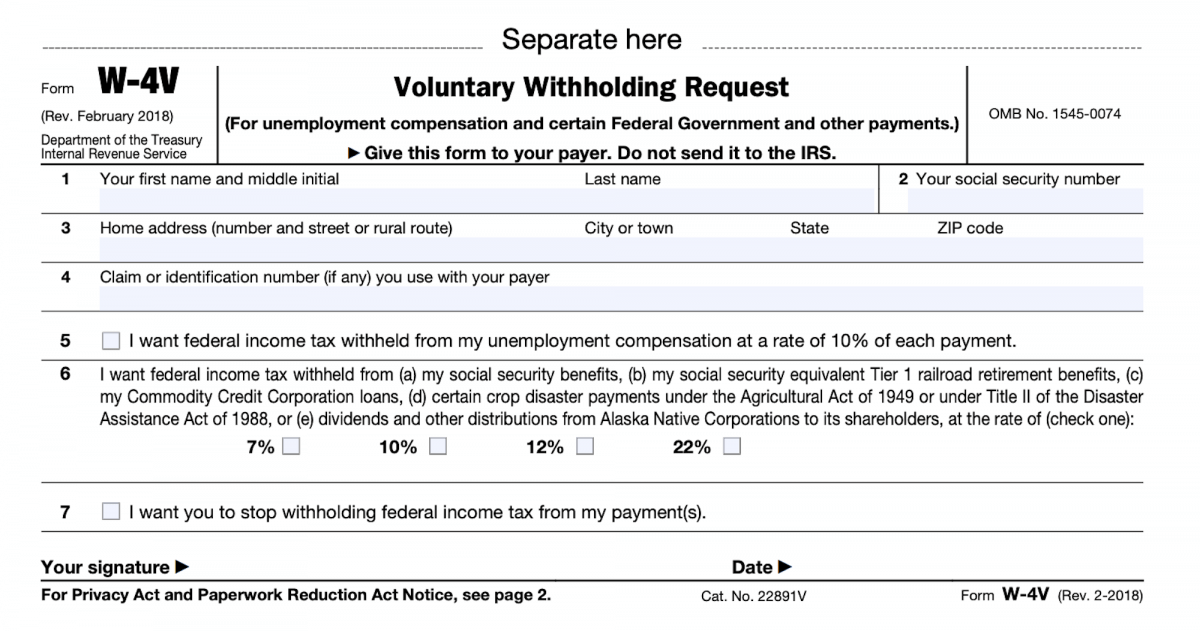

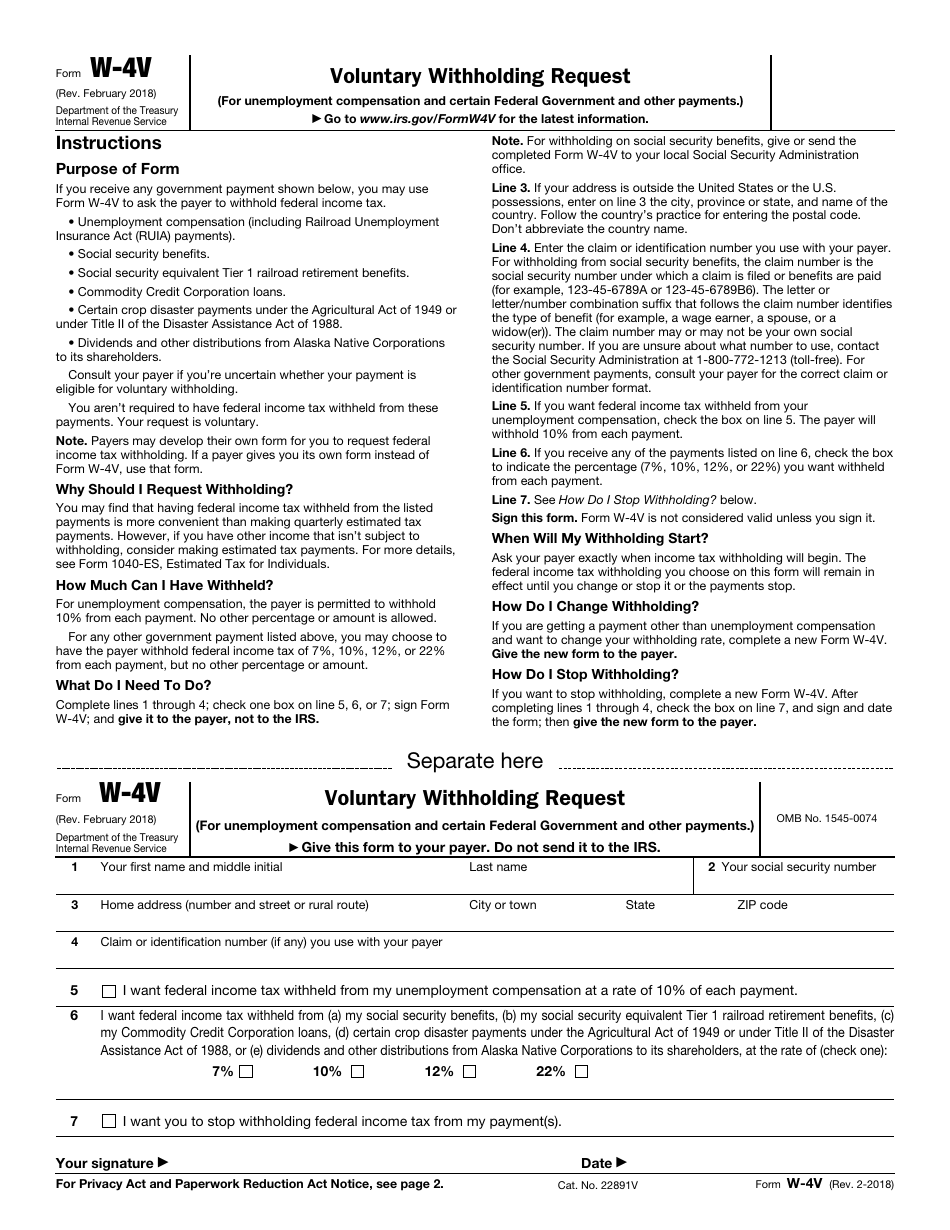

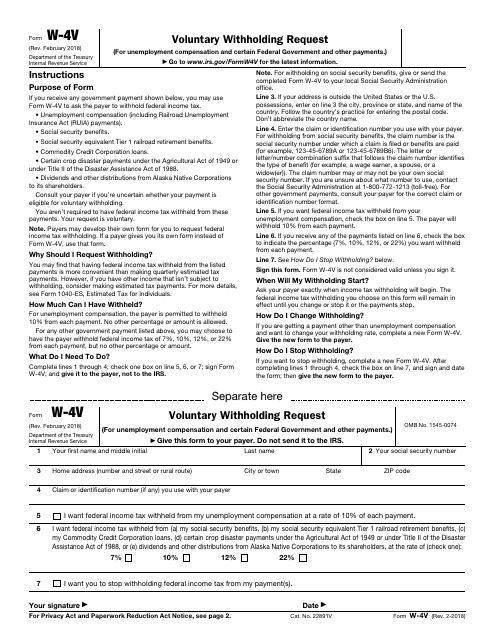

Follow the countrys practice for entering the postal code.

Social security tax withholding form w 4v. About Form W-4 V Voluntary Withholding Request. Enter the claim or. If I use Form W-4V to withhold 7 of my social security benefit for federal income tax will Social Security multiply that 7 times my gross benefit or will they first subtract out Medicare Part B and Part D premium amounts.

Dont abbreviate the country name. Use your indications to submit established track record areas. The letter or letternumber combination suffix that follows.

W-4 is normally filled in in the end of a year or when some modifications happen in personal economic state. Possessions enter on line 3 the city province or state and name of the country. If you are already receiving benefits or if you want to change or stop your withholding youll need a form.

Get access via all gadgets including PC mobile and tablet. I need to subtract more from my mothers Social Security check fro. For withholding on social security benefits give or send the completed Form W-4V to your local Social Security Administration office.

If youre already getting benefits and then later decide to start withholding youll need to fll in a voluntary withholding request also known as Internal Revenue Service Form W-4V and submit it by mail or in person to your local Social Security office. Enter your identification or claim number you use with your payer. Other Federal Individual Income Tax Forms.

Skip lines 5 and 6 on the 2019 W4 Form and complete line 7. A taxpayer downloads Form W-4V Voluntary Withholding Request from IRSgov according to the Social Security Administration. After completing the form the taxpayer returns it to the agency issuing the benefits.

Make sure that you enter. Enter the claim or identification number you use with your payer. We last updated Federal W-4V in January 2021 from the Federal Internal Revenue Service.

W-4V Form Instructions State your full name and social security number. If you receive any government payment shown below you may use this form to ask the payer to withhold federal income tax. Add your own info and speak to data.

Fill out the Personal Allowances Worksheet Page 3. A According to the Social Security Administration You can ask us to withhold federal taxes from your Social Security when you apply for benefits. Social Security Forms W4V Form W-4 is an Employees Withholding Allocation Certification which is completed by an staff member in order the right government income tax obligation to be deducted from hisher settlement.

If your address is outside the United States or the US. Withholding Income Tax From Your Social Security Benefits. This form is for income earned in tax year 2020 with tax returns due in April 2021.

Secure and user-friendly tools. Follow the countrys practice for entering the postal code. It may be your own social security number.

Filing the form is not mandatory but a taxpayer who wishes to withhold federal income tax from. You can specify when you file your claim for Social Security benefits that you want federal income taxes withheld from the payments. How to complete any Form W-4V online.

For withholding from social security benefits the claim number is social security number under which a claim is filed or benefits are paid for example-- or--6. As of 2015 a taxpayer may also dial 1-800-829-1040 to request the form. I thought I saw somewhere that they would apply the percentage to the net amount after the premiums are subtracted out but now I cant find anything in writing.

On the site with all the document click on Begin immediately along with complete for the editor. The W-4V Voluntary Withholding Request form has a choice that allows you to take 22 out of your Social Security salary for one year. Congrats on the new job.

Put your information print download or send your template. We will update this page with a new version of the form for 2022 as soon as it is made available by the Federal government. Complete lines 1 to 4 of the 2019 W4 Form.

Possessions enter on line 3 the city province or state and name of the country. Here are instructions for Line 4. 159 Zeilen Authorization to Disclose Information to the Social Security Administration.

You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply. Our blank samples are fillable and editable online W4 2020. This makes a difference to how I fill out the form.

If your address is outside the United States or the US. Write down your home address. Indicate if you want federal income tax withheld from the unemployment compensation and.

For withholding on social security benefits give or send the completed Form W-4V to your local Social Security Administration office.

Irs Form W 4v Download Fillable Pdf Or Fill Online Voluntary Withholding Request Templateroller

Irs Form W 4v Download Fillable Pdf Or Fill Online Voluntary Withholding Request Templateroller

Irs Form 4v Fill Online Printable Fillable Blank Pdffiller

Irs Form 4v Fill Online Printable Fillable Blank Pdffiller

Social Security Recipients To Get Bigger Benefits In 2021 But Some Retiree Money Could Be Taxable Don T Mess With Taxes

Taxes From A To Z 2020 V Is For Voluntary Withholding Taxgirl

Taxes From A To Z 2020 V Is For Voluntary Withholding Taxgirl

Withholding Federal Taxes From Your Social Security Benefits Transit Managerial Benevolent Association

Form W 4v Voluntary Withholding Request

Form W 4v Fillable Voluntary Withholding Request

Irs Form W 4v Download Fillable Pdf Or Fill Online Voluntary Withholding Request Templateroller

Irs Form W 4v Download Fillable Pdf Or Fill Online Voluntary Withholding Request Templateroller

Irs Form W 4v Download Fillable Pdf Or Fill Online Voluntary Withholding Request Templateroller

Irs Form W 4v Download Fillable Pdf Or Fill Online Voluntary Withholding Request Templateroller

Withholding Taxes From Social Security Kiplinger

Withholding Taxes From Social Security Kiplinger

Https Www Irs Gov Pub Irs Prior Fw4v 2006 Pdf

Can You Change Social Security Tax Withholding Online Fill Online Printable Fillable Blank Pdffiller

Can You Change Social Security Tax Withholding Online Fill Online Printable Fillable Blank Pdffiller

Social Security Recipients To Get Bigger Benefits In 2021 But Some Retiree Money Could Be Taxable Don T Mess With Taxes

W 4 V V O L U N T A R Y W I T H H O L D I N G R E Q U E S T F O R M Zonealarm Results

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.