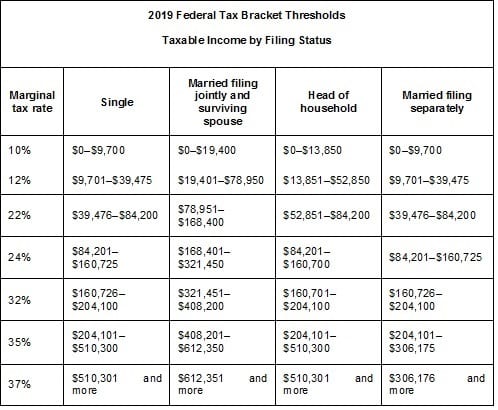

A child that is too old to qualify as a child might be able to qualify as a relative for Head of Household. Head of Household HOH Filing Status Head of household HOH filing status allows you to file at a lower tax rate and a higher standard deduction than the Single filing status.

Who Can Claim Head Of Household On Taxes Rules And Penalty Toughnickel

Who Can Claim Head Of Household On Taxes Rules And Penalty Toughnickel

If you are a US.

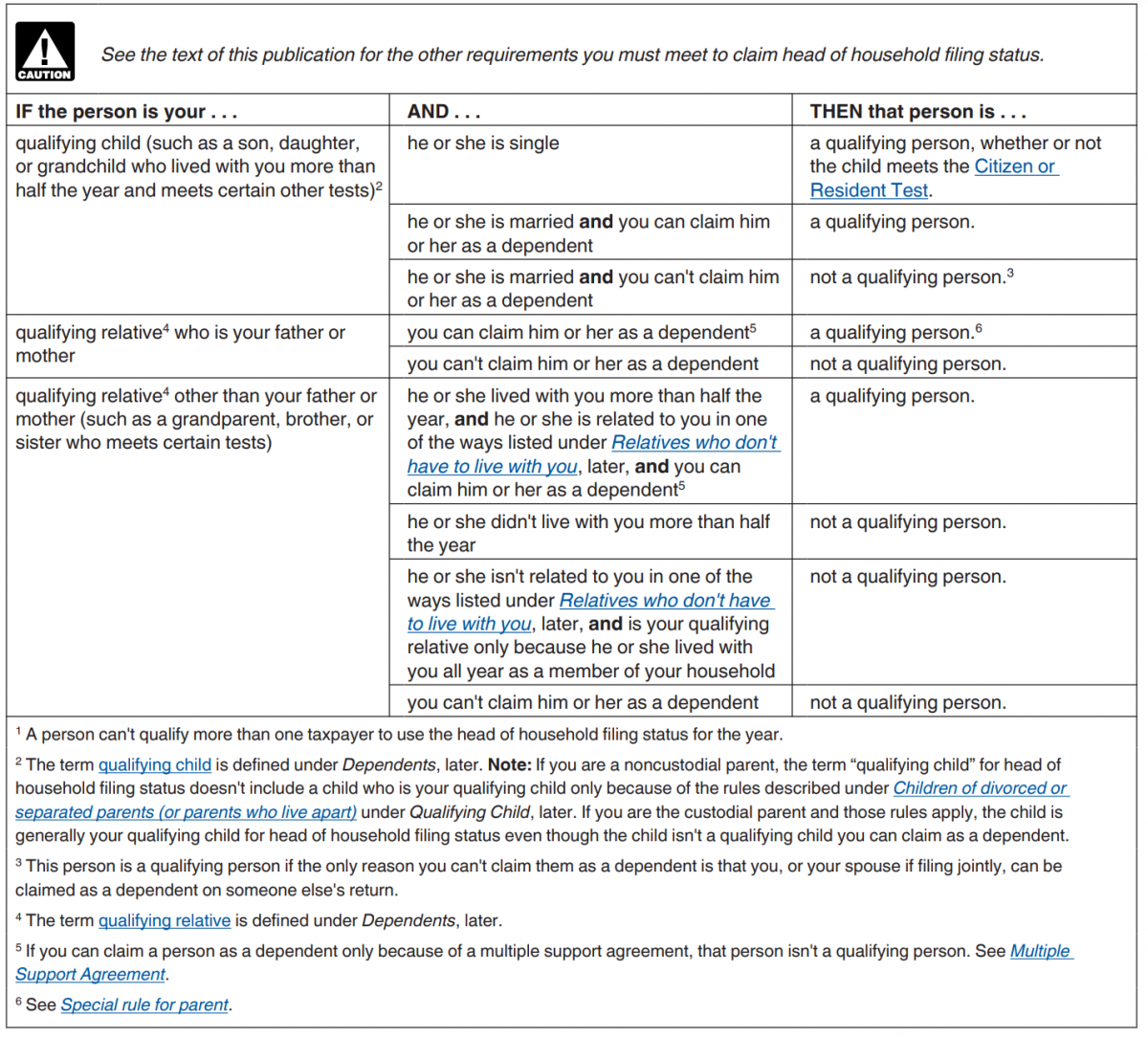

Qualifications for filing head of household. To claim head-of-household status you must be legally single pay more than half of household expenses and have either a qualified dependent living with you for at least half the year. Pay for more than half of the household expenses Be considered unmarried for the tax year and You must have a qualifying child or dependent. For purposes of filing as head of household the IRS considers you unmarried for.

You must pay more than You must pay more than half the cost of keeping up a home that was the main home for the entire year for your parent. Internal Revenue Service IRS. You might be able to claim head of household HOH filing status if you meet these requirements.

Youre unmarried or considered unmarried on the last day of 2020. You may be able to choose head of household filing status if you are considered unmarried because you live apart from your spouse and meet certain tests explained later under Head of Household. You are unmarried or considered unmarried at the end of the year.

You are considered unmarried for head of household purposes if your spouse was a nonresident alien at any time during the year and you do not choose to treat your nonresident spouse as a resident alien. Head of the household is one of several statuses a party can claim when filing for taxes according to the US. A qualifying person lived with you in the home for more than half the.

Have paid for more than half of the household expenses for the tax filing year. A qualifying relative would be. Have a qualifying child or dependent.

You can use eFiles specific guidelines to help you understand and determine whether or not you meet the head of household filing criteria. To file as head of household you must. The head of household is not married but unlike.

Choosing this status by mistake may lead to your HOH filing status being denied at the time you file your tax return. Were unmarried as of December 31 2020 and Paid more than half the cost to run your or a qualifying parents home this year rent mortgage utilities etc and Supported a qualifying person. 6 You are eligible to file as head of household even if your parent whom you can claim as a dependent doesnt live with you.

Qualifying for head of household status means meeting a series of interlocking rules involving your marital status paying for more than half your households expenses and having a dependent. If you qualify to file as head of household instead of as married filing separately your tax may be lower you may be able to claim the earned. You paid more than half the cost of keeping up a home for the year.

Be unmarried on December 31 of the filing tax year. To be eligible to file as head of household you must pass the three questions test fail one of these questions and youre out well at least out of the HOH filing status. Citizen married to a nonresident alien you may qualify to use the head of household tax rates.

You can qualify for Head of Household if you. This can apply to you even if you arent divorced or legally separated. Your mother or father including your stepfather or stepmother if youre qualified to claim them as a dependent even if youre not claiming them as.

The first qualification to file as head of household is that you must be unmarried on the last day of the tax year. But to qualify you must meet specific criteria.

Head Of Household Qualifications Tax Brackets And Deductions Thestreet

Head Of Household Qualifications Tax Brackets And Deductions Thestreet

Better Brackets And Benefits When Filing As Head Of Household Fuoco Group

Better Brackets And Benefits When Filing As Head Of Household Fuoco Group

Http Www Healthreformbeyondthebasics Org Wp Content Uploads 2018 12 Referenceguide Tax Filing Status And Dependent Rules Pdf

/head-of-household-filing-status-3193039_final-e1ff704b38ee49bc83351f263f213ac4.png) How To File Your Taxes As Head Of Household

How To File Your Taxes As Head Of Household

Http Www Healthreformbeyondthebasics Org Wp Content Uploads 2014 07 The Health Care Assister Guide To Tax Rules Pdf

/two-heads-of-household-3193038_final-52aaf4f7fe1245ceaac454b66758f0ab.png) Can Two People Claim Head Of Household At Same Address

Can Two People Claim Head Of Household At Same Address

Taxes From A To Z 2020 H Is For Head Of Household Taxgirl

Taxes From A To Z 2020 H Is For Head Of Household Taxgirl

What Are The Basics Of The Head Of Household Tax Filing Status Purposeful Finance

What Are The Basics Of The Head Of Household Tax Filing Status Purposeful Finance

Qualifying Person Qualifying You To File As Head Of Household Aving To Invest

Qualifying Person Qualifying You To File As Head Of Household Aving To Invest

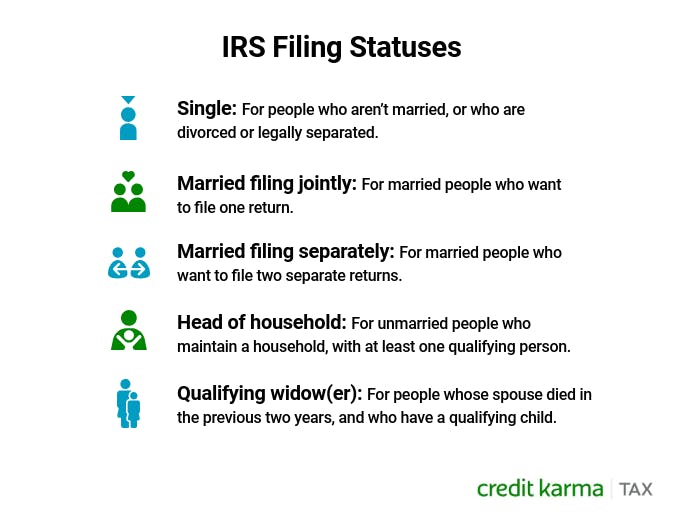

Filing As Head Of Household What To Know Credit Karma Tax

Filing As Head Of Household What To Know Credit Karma Tax

Who Should File Head Of Household

Who Should File Head Of Household

Learn How An Employee S Filing Status Affects Payroll

Learn How An Employee S Filing Status Affects Payroll

What Is A Head Of Household Tax Lingo Defined Youtube

What Is A Head Of Household Tax Lingo Defined Youtube

Difference Between Single And Head Of Household Compare The Difference Between Similar Terms

Difference Between Single And Head Of Household Compare The Difference Between Similar Terms

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.